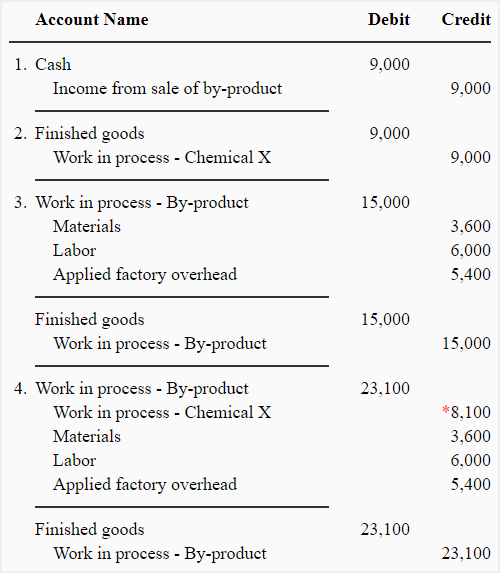

Replacement Cost Accounting Technique RCA Journal Entry

Просмотров:

The replacement cost method is an accounting approach that values assets based on the cost to replace them with new ones at current market prices. This method is particularly useful for evaluating the worth of by-products, as it considers the expenses involved in producing or acquiring replacements rather than their historical costs. By focusing on current values, this method helps businesses make informed decisions regarding resource allocation and pricing strategies.

What is a replacement cost accounting?

The construction or replacement of the building uses modern materials and current methods, designs, and layouts. Replacement cost is a cost that is required to replace any existing asset having similar characteristics. An organization often chooses to replace its assets when the repair and maintenance costs increase beyond an acceptable level over some time. The paper seeks to stimulate debate on the current professional guidance for the use of the replacement cost method of valuation. Posting the cost of an asset purchase to an asset account and subsequently depreciating it over the asset’s useful life constitutes capitalizing on the acquisition. After conducting market research, ABC Inc. determines that similar trucks with the same specifications and features are currently priced at $60,000 each in the market.

Depreciated Replacement Cost

The price at which an asset would sell in a competitive auction setting, assuming both buyer and seller are knowledgeable, willing, and under no undue pressure. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Which of these is most important for your financial advisor to have?

November 2024 bulletin of regional construction cost insights reflecting the CoreLogic Claims Pricing Database. In this case, the management should replace the machinery since it will add value to the business in the future. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Market Value vs. Replacement Cost

This paper argues that market value assumptions do not hold in the case of the replacement cost method. Determining the replacement cost of a building is a nuanced process that necessitates a comprehensive understanding of construction, coupled with the careful analysis of various data points. We have to deduct 60% from the market price as the current truck is already depreciated for 60%. Without depreciated percentage, we can calculate comparing the year of depreciated over the total useful life. The supply and demand for housing also impacts the fair market value, just as the supply and demand for labor and materials affect replacement cost. When situations arise where supply does not match or equal demand, market value and the replacement cost can change quickly.

The rca technique uses the index that is most directly relevant to the company’s individual assets and not the general price index. Insurance companies routinely use replacement costs to determine the value of an insured item. The practice of calculating a replacement cost is known as «replacement valuation.» When determining the replacement cost of an asset, businesses must consider depreciation to spread its cost over its useful life. To arrive at an informed estimate, businesses employ the net present value (NPV) method, utilizing a discount rate to gauge the minimum rate of return on the asset. When computing the replacement cost of an asset, companies must factor in depreciation costs.

Budgeting for asset replacements is crucial, as it is integral to the ongoing operation of the business. Unless specifically added to your cost estimate, the CoreLogic costs do not include real estate commissions, land, landscaping, sidewalks, how to calculate vacation accruals free pto calculator driveways, patios, well and septic systems, sewer and water systems, and other land improvements. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- The second step is to calculate Depreciation on an annual basis, using either the historical cost or current purchasing power methodologies.

- The decision to replace an asset can be financially significant, prompting companies to analyze the net present value (NPV) of future cash inflows and outflows to inform purchasing decisions.

- Accountants, who rely on depreciation to allocate the cost of an asset over its useful life, also commonly use replacement costs.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. CPP suffers from the problem that it does not consider the individual price index related to the particular assets of a company. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Therefore, the replacement cost of each truck is $60,000, reflecting the amount ABC Inc. would need to spend to acquire a new truck with similar capabilities. The insurance company’s primary function is to evaluate whether the decision of replacement is better than repair and maintenance. It is also vital for a company to correctly calculate the depreciation since it will have a significant impact on the decision to continue the old asset or replace it with a new one.

Consider a manufacturing company, ABC Inc., that owns a fleet of delivery trucks used for transporting goods to customers. To assess the current value of its fleet, ABC Inc. decides to calculate the replacement cost of its trucks based on current market prices. The replacement cost method is a valuation approach that estimates the cost to replace an asset with a new one of similar kind and quality, adjusting for physical depreciation. This method is particularly useful in determining the value of tangible assets and can be employed when market data is scarce. By focusing on the cost required to recreate the asset rather than its current market value, this method provides a practical perspective on asset valuation, especially in contexts where fair market value assessments are difficult to obtain. If a company’s asset has a historical cost that differs widely from its current market price, the replacement cost might increase the value of the company.

Businesses can assess the depreciation cost of the item against the market value of the same and then decide whether to replace it. When depreciation is charged on historical cost, it will not match the cost of the replaced asset. The cost to replace an asset can change, depending on variations in the market value of the asset and other costs needed to get the asset ready for use.